The state of the South African Housing Market is under pressure now more so than ever before owing to the spread of COVID-19. Though the national lockdown only started near the end of March, Adrian Goslett, Regional Director and CEO of RE/MAX of Southern Africa, says that the Housing Report figures for the first quarter of 2020 already reflect the start of COVID-19’s effect on the property market.

“According to Lightstone Property data, a total of 37,609 bond registrations were recorded at the Deeds Office over the period of January to March 2020. This translates into a 5.6% decrease in the number of bonds registered YoY and a 1.2% decrease QoQ. Beyond this, the number of transfers (both bonded and unbonded) recorded at the Deeds Office between January and March amounted to 51,315, which is a 10.5% decrease from last year and an 18.7% decrease from Q4 2019. These figures all suggest that concerns around COVID-19 have already slowed activity within the housing market,” he explains.

Freehold Properties Outperform Sectional Titles

Interestingly, sectional titles seem to have been affected the worse by current market conditions. Reflecting a significant decline, the national median price of sectional titles* dropped by 8.2% to R963,971 from the R1,049,810 reported in Q1 2019 and dropped by 5.9% since last quarter.

“The average bond amount granted during this period decreased by 1.2% since last quarter to R1,098,000* and by 0.4% since Q1 2019. This might reflect the slight downward pressure on property prices,” says Goslett.

On the other hand, the current national median price of a freehold home* has grown to R1,183,943 which is a 5.5% increase on the median asking price for Q1 2019 (R1,122,349). When compared to last quarter, the median asking price increased by 4.6%. The average active RE/MAX listing price amounted to R2,984,995.16 for Q1 2020, which is a 14.9% increase YoY.

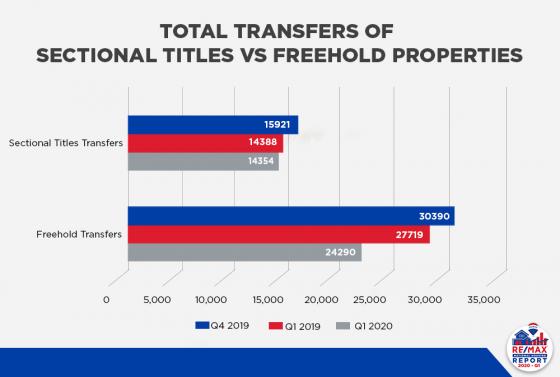

Of the 51,315 transfers, a total of 24,290 freehold properties and 14,354 sectional title units were sold countrywide (*these figures exclude estates, farms, and land only transfers). In contradiction to the price performance of each segment, the number of freehold properties sold decreased by 12.4% YoY while sectional titles only saw a 0.2% decrease YoY.

Breakdown of sales per price point

Properties below R400,000 continue to account for the largest portion of sales at 29.2%* of the total transfers. Properties between R400,000-R800,000 make up 24.2%* of the total transfers, which is slightly less than the 25.8%* for which properties between R800,000 and R1,5 million account. Properties between R1,5 million to R3 million accounted for 15.8%* and, making up the smallest portion of total transfers, properties priced above R3 million accounted for 5%* of the total transfers.

“Considering how poorly our economy is performing, one might expect to see a decline in activity within the higher price bands. However, the current figures do not reflect that any one price band has seen a significant shift in market activity,” explains Goslett.

Reviewing the provincial property markets

Gauteng continued to dominate the top five searched suburbs nationally on remax.co.za during Q1 2020, claiming four of the spots with Morningside landing the number one position for the third consecutive quarter, followed by Fourways, then Musgrave in KwaZulu-Natal, Faerie Glen, and lastly Bryanston.

Final thoughts

“The results of the first quarter paint a picture of what is ahead. My prediction is that we are likely to see even slower growth in the next quarter as our economy recovers from the lockdown and the other fiscal consequences of COVID-19. That being said, I am confident that investors will stand to make good returns by purchasing property now,” Goslett concludes.

*Figures according to Lightstone Property